slonimdrevmebel.ru

Prices

Secured Loan Process

A secured collateral loan requires that the borrower use their assets (such as a car, house or savings account) as collateral to “secure” the loan. The. Lenders often issue loans secured by a specific item of personal property. This item might be your house, car, a boat, or even stocks or bonds. That property is. A fixed-rate loan, secured with a Regions CD, savings account or money market. Receive up to % of the available balance in the deposit account securing the. Which loans – secured loans or unsecured loans – typically have higher loan limits and repayment terms? While this process doesn't result in the loss. As you make monthly payments, the amount on hold in your savings account is reduced and then made available to you as security on the loan. As you make payments. How to apply for Secured Loan · Visit the website or office of the concerned bank or NBFC · Fill in the application form - you can find most application form on. Secured loans are personal loans backed (or guaranteed) by a valuable piece of property (called collateral). If you don't pay back your loan, your lender can. Secured Loans. It truly pays to save. Use your hard-earned savings to access cash for practically anything — and improve your credit in the process! Apply. This process varies from lender to lender but can take several weeks. You can always ask for an estimated time at the point you decide to proceed. A secured collateral loan requires that the borrower use their assets (such as a car, house or savings account) as collateral to “secure” the loan. The. Lenders often issue loans secured by a specific item of personal property. This item might be your house, car, a boat, or even stocks or bonds. That property is. A fixed-rate loan, secured with a Regions CD, savings account or money market. Receive up to % of the available balance in the deposit account securing the. Which loans – secured loans or unsecured loans – typically have higher loan limits and repayment terms? While this process doesn't result in the loss. As you make monthly payments, the amount on hold in your savings account is reduced and then made available to you as security on the loan. As you make payments. How to apply for Secured Loan · Visit the website or office of the concerned bank or NBFC · Fill in the application form - you can find most application form on. Secured loans are personal loans backed (or guaranteed) by a valuable piece of property (called collateral). If you don't pay back your loan, your lender can. Secured Loans. It truly pays to save. Use your hard-earned savings to access cash for practically anything — and improve your credit in the process! Apply. This process varies from lender to lender but can take several weeks. You can always ask for an estimated time at the point you decide to proceed.

Secured loans. · What is a secured loan? A secured loan, also known as a 'second charge mortgage' is a type of finance that allows you to borrow money against a. Homeowner loans (AKA secured loans), usually take between three to four weeks to process. Exactly how long it takes will vary depending on your personal. The Service Center works with the commercial lender to process the guarantee. The Farm Loan Officer reviews the application for applicant eligibility, repayment. Loan is secured by the funds in your deposit account, which must equal at least % of the loan amount; Fast approval process; Prompt, professional attention. *The Best Egg Secured Loan is a personal loan secured using a lien against fixtures permanently attached to your home such as built-in cabinets, light fixtures. Share secured loans allow you to borrow against your own savings or certificate, using it as collateral. Because they are secured by collateral, secured loans typically have lower interest rates than unsecured loans. How can a secured loan help improve my credit? A secured loan is any borrowed money backed by collateral. Collateral is a financial asset you offer to give the bank if you don't repay the loan. Savings Secured Loans Have a Certificate of Deposit (CD) or Savings account with us? Use them to secure your loan. That way you can stick with your savings. For certificate or savings secured, the funds are held as collateral in your account for a specific period of time-based on the terms of the loan. The money. It can take up to four weeks to complete a secured loan application and receive your funds, though this timeframe can be reduced to as little as 1 week in some. Loans. Loans. Find out which SBA-guaranteed loan program is best for your business, then use Lender Match to be matched to lenders. Find lenders. How SBA helps. For certificate or savings secured, the funds are held as collateral in your account for a specific period of time-based on the terms of the loan. The money. 1. Applying for a secured loan is similar to applying for a mortgage or car loan. You'll need to fill out a loan application and provide information about your. The secured component of the loan means the debt is collateralized with company assets or property. If the borrower goes bankrupt, those assets can be sold to. Secured loans, or collateral-based business loans, are financial agreements where your business obtains a lump sum of money. Loan is secured by the funds in your deposit account, which must equal at least % of the loan amount; Fast approval process; Prompt, professional attention. With Savings–Secured Loans, you can use your savings as collateral, borrow at low rates, and keep your savings intact. Fast Application. Applying for a loan. A secured loan is a loan attached to your home. If you cannot pay the debt, the lender can apply to the courts and force you to sell your home to get their. If the secured loan results in a default, they can repossess the collateral to recoup the loss. Minimizing the lending risk this way, lenders can work with.

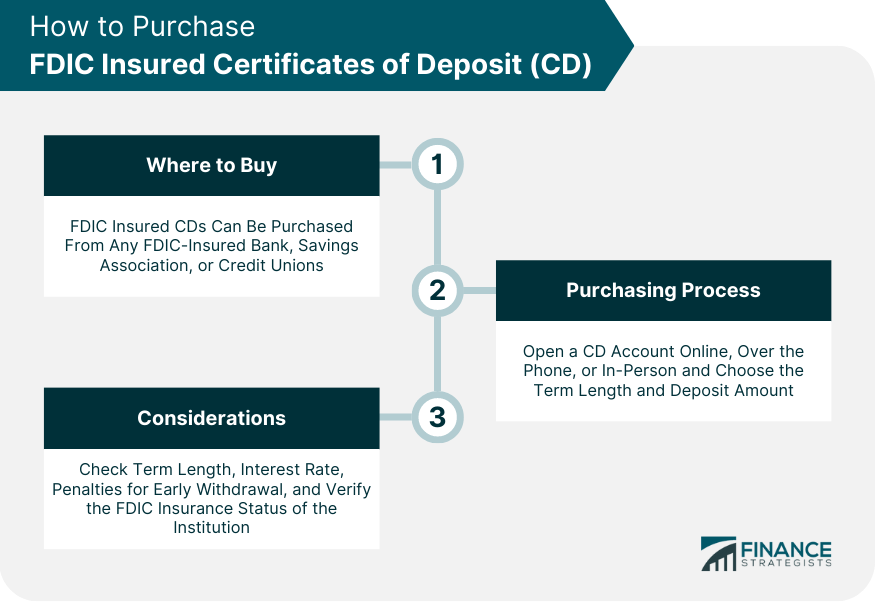

Are Cds Insured By The Fdic

The majority of CDs are provided through banks or credit unions, and these bank options are insured by the Federal Deposit Insurance Corp. (FDIC) for up to. FDIC insurance covers funds in deposit accounts, including checking and savings accounts, money market deposit accounts and certificates of deposit (CDs). Because the FDIC insurance covers CDs up to $, and the limit can be surpassed by holding CDs at multiple insured banks, there isn't a market for other. These deposits and official items qualify for deposit insurance coverage, at an FDIC insured bank. However, some investments are not insured even if they were. Certificates of deposit available through Schwab CD OneSource typically offer a fixed rate of return, although some offer variable rates. They are FDIC-insured. The short story: Your accounts are insured up to $, per bank. The longer story: As an individual account holder, you're FDIC insured for up to $, at. Your deposits are automatically insured to at least $, at each FDIC-insured bank. Certificates of Deposit (CDs). Coverage is automatic when you open one. PNC Bank is a member of the Federal Deposit Insurance Corporation (FDIC). The Federal Deposit Insurance Corporation (FDIC) is a federal agency organized in. The principal amount of an index-linked CD is insured by the FDIC up to the maximum applicable deposit insurance coverage. The majority of CDs are provided through banks or credit unions, and these bank options are insured by the Federal Deposit Insurance Corp. (FDIC) for up to. FDIC insurance covers funds in deposit accounts, including checking and savings accounts, money market deposit accounts and certificates of deposit (CDs). Because the FDIC insurance covers CDs up to $, and the limit can be surpassed by holding CDs at multiple insured banks, there isn't a market for other. These deposits and official items qualify for deposit insurance coverage, at an FDIC insured bank. However, some investments are not insured even if they were. Certificates of deposit available through Schwab CD OneSource typically offer a fixed rate of return, although some offer variable rates. They are FDIC-insured. The short story: Your accounts are insured up to $, per bank. The longer story: As an individual account holder, you're FDIC insured for up to $, at. Your deposits are automatically insured to at least $, at each FDIC-insured bank. Certificates of Deposit (CDs). Coverage is automatic when you open one. PNC Bank is a member of the Federal Deposit Insurance Corporation (FDIC). The Federal Deposit Insurance Corporation (FDIC) is a federal agency organized in. The principal amount of an index-linked CD is insured by the FDIC up to the maximum applicable deposit insurance coverage.

Information to keep in mind · EverBank, N.A. is an FDIC-insured national banking association. · The quoted CDARS® CD Annual Percentage Yields (APYs) are accurate. FDIC Coverage insures all TD Bank's deposit accounts, including checking, savings, money market accounts and CDs, up to the FDIC Insurance Limit. Deposits are insured by the FDIC up to $, per depositor. Term. Choose from multiple options: 7 month to 37 month. See available terms and rates. View our current list of banks Edward Jones partners with for brokered FDIC-insured certificates of deposit (CDs). Contact your financial advisor to. At Wells Fargo, deposits are FDIC protected and insured. Learn more. Your Regions deposits are fully protected up to the standard deposit insurance amount by the Federal Deposit Insurance Corporation (FDIC). An FDIC-insured CD may be ideal for both conservative investors and investors who want to balance their portfolios with secure investments. • CDs have. Some types of CDs are available with the highest level of safety – FDIC insurance – while others are not. The main factor that determines which CDs are covered. Are CDs covered by FDIC insurance? Most banks are federally insured by the FDIC, while credit unions are insured by NCUA, and some financial institutions. FDIC insurance does not cover market losses. All of the new issue brokered CDs Fidelity offers are FDIC insured. In some cases, CDs may be purchased on the. Certificates of deposit (CDs) are a valuable tool for building financial wellness, and the FDIC insures CDs up to a certain amount. As a saver, you receive up to $, of FDIC coverage per depositor, per bank, per account ownership type. So if you have up to $, at one bank, spread. Currently, the FDIC insures $, per depositor, per FDIC-insured bank, per ownership category. Customers at financial institutions are not required to apply. But investments like stocks, bonds, mutual funds and other equities are not covered The FDIC also limits how much money can be insured in a given account. As an FDIC-insured bank, eligible US Bank consumer and business deposits are insured unconditionally by the United States government. Examples of FDIC insurance coverage: · Example 1: If you have a Schwab brokerage account, in just your name, with two $, CDs from two different banks, and. How To Know If Your Deposits Are FDIC-Insured. · Banc of California is a member of the FDIC. · The FDIC was created in to provide insurance protection for. FDIC insurance covers funds in checking and savings accounts, money market deposit accounts and certificates of deposit (CDs). As of July 21, , all CDs are federally insured up to $, per depositor, per bank. In determining the applicable insurance limits, the FDIC aggregates. Your deposits are insured only if your bank has Federal Deposit Insurance Corporation (FDIC) deposit insurance.

Van Eck Wide Moat Etf

The fund normally invests at least 80% of its total assets in securities that comprise the fund's benchmark index. The index is comprised of securities issued. VanEck Morningstar Wide Moat ETF MOAT. VanEck Morningstar Wide Moat ETF MOAT | Page 1. VanEck Morningstar Wide Moat ETF MOAT | Page 2. Axos Financial, Inc. VanEck's Moat ETF invests in US stocks that Morningstar considers to have strong competitive advantages and be attractively priced. Risk of capital loss. Fund Overview. The investment seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Morningstar® Wide. ETF strategy - VANECK MORNINGSTAR WIDE MOAT ETF - Current price data, news, charts and performance. % p.a., Accumulating, Ireland, Full replication. VanEck Morningstar US Wide Moat UCITS ETF AIEI99HX7, 41, % p.a., Accumulating. The Fund seeks to replicate the price and yield performance of the Morningstar Wide Moat Focus Index. The Index provider selects the top 20 companies to be. Get the latest VanEck Morningstar Wide Moat ETF (MOAT) real-time quote, historical performance, charts, and other financial information to help you make. MOAT Portfolio - Learn more about the VanEck Morningstar Wide Moat ETF investment portfolio including asset allocation, stock style, stock holdings and. The fund normally invests at least 80% of its total assets in securities that comprise the fund's benchmark index. The index is comprised of securities issued. VanEck Morningstar Wide Moat ETF MOAT. VanEck Morningstar Wide Moat ETF MOAT | Page 1. VanEck Morningstar Wide Moat ETF MOAT | Page 2. Axos Financial, Inc. VanEck's Moat ETF invests in US stocks that Morningstar considers to have strong competitive advantages and be attractively priced. Risk of capital loss. Fund Overview. The investment seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Morningstar® Wide. ETF strategy - VANECK MORNINGSTAR WIDE MOAT ETF - Current price data, news, charts and performance. % p.a., Accumulating, Ireland, Full replication. VanEck Morningstar US Wide Moat UCITS ETF AIEI99HX7, 41, % p.a., Accumulating. The Fund seeks to replicate the price and yield performance of the Morningstar Wide Moat Focus Index. The Index provider selects the top 20 companies to be. Get the latest VanEck Morningstar Wide Moat ETF (MOAT) real-time quote, historical performance, charts, and other financial information to help you make. MOAT Portfolio - Learn more about the VanEck Morningstar Wide Moat ETF investment portfolio including asset allocation, stock style, stock holdings and.

VanEck Morningstar Wide Moat Growth ETF (MGRO) seeks to track as closely as possible, before fees and expenses, the price and yield performance of the. What Is the VanEck Vectors Morningstar Wide Moat Ticker Symbol? MOAT is the ticker symbol of the VanEck Vectors Morningstar Wide Moat ETF. What Is the MOAT. Invest in global companies that possess sustainable competitive advantages, called "wide moats", according to Morningstar. A strategy popularised by W. View VanEck Vectors Morningstar Wide Moat ETF (MOAT) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Find the latest VanEck Morningstar Wide Moat ETF (MOAT) stock quote, history, news and other vital information to help you with your stock trading and. MOAT Mutual Fund Guide | Performance, Holdings, Expenses & Fees, Distributions and More. A list of holdings for MOAT (VanEck Morningstar Wide Moat ETF) with details about each stock and its percentage weighting in the ETF. Latest VanEck Morningstar Wide Moat ETF (MOAT:BTQ:USD) share price with interactive charts, historical prices, comparative analysis, forecasts. VanEck Morningstar Wide Moat ETF. MOAT tracks a staggered, equal-weighted index of 40 US companies that Morningstar determines to have the highest fair value. Performance charts for VanEck Morningstar Wide Moat ETF (VEFH - Type ETF) including intraday, historical and comparison charts, technical analysis and trend. MOTG - Overview, Holdings & Performance. The ETF offers exposure to attractively priced global companies with sustainable competitive advantages. Learn everything about VanEck Morningstar Wide Moat ETF (MOAT). News, analyses, holdings, benchmarks, and quotes. VanEck; MOAT. MOAT. VanEck Morningstar Wide Moat ETF. Price: $ Change: $ (%). Category: All Cap Equities. Last Updated: Sep 06, VanEck MOAT ETF (VanEck Morningstar Wide Moat ETF): stock price, performance, provider, sustainability, sectors, trading info. Get VanEck Morningstar Wide Moat ETF (MOAT:CBOE) real-time stock quotes, news, price and financial information from CNBC. % p.a., Accumulating, Ireland, Full replication. VanEck Morningstar US Wide Moat UCITS ETF AIEI99HX7, 41, % p.a., Accumulating. Wide moat companies are those that Morningstar's equity research team believes will maintain its competitive advantage(s) for at least 20 years. Narrow moat. VanEck Morningstar Wide Moat ETF MOAT has $0 invested in fossil fuels, 0% of the fund. In depth view into MOAT (VanEck Morningstar Wide Moat ETF) including performance, dividend history, holdings and portfolio stats. VanEck's MOAT ETF ($MOAT), invests in companies with sustainable competitive advantages, or 'wide moats', identified by Morningstar's equity research.

Realestate Disclosure

property by a licensed real estate broker 47E requires residential property owners to complete this Disclosure Statement and provide it to the buyer. The Seller's Property Disclosure Statement is used to disclose known defects and conditions on the property. The Seller's Residential Real Estate Disclosure Form is a representation of the seller's knowledge of the condition of the home, not the actual condition of the. As previously mentioned, sellers of real property have a duty to disclose material information, such as “latent defects” to a buyer of a property. This duty. THE FOLLOWING ARE DISCLOSURES MADE BY SELLER AND ARE NOT THE REPRESENTATIONS OF ANY REAL ESTATE LICENSEE OR OTHER PARTY. THIS INFORMATION IS FOR DISCLOSURE ONLY. California real estate law requires sellers to disclose to buyers of their real property "any material facts known to the seller affecting the value or. Seller: The purpose of this Disclosure Statement is to disclose, to the best of Seller's knowledge, the condition of the Property, as of the date set forth. As a general rule, all sellers of residential real estate property containing one to four units in California must complete and provide written disclosures to. Broker Disclosure Requirements. Will Our Real Estate Agent Tell Prospective Buyers About Home Defects? Home sellers have certain disclosure obligations in most. property by a licensed real estate broker 47E requires residential property owners to complete this Disclosure Statement and provide it to the buyer. The Seller's Property Disclosure Statement is used to disclose known defects and conditions on the property. The Seller's Residential Real Estate Disclosure Form is a representation of the seller's knowledge of the condition of the home, not the actual condition of the. As previously mentioned, sellers of real property have a duty to disclose material information, such as “latent defects” to a buyer of a property. This duty. THE FOLLOWING ARE DISCLOSURES MADE BY SELLER AND ARE NOT THE REPRESENTATIONS OF ANY REAL ESTATE LICENSEE OR OTHER PARTY. THIS INFORMATION IS FOR DISCLOSURE ONLY. California real estate law requires sellers to disclose to buyers of their real property "any material facts known to the seller affecting the value or. Seller: The purpose of this Disclosure Statement is to disclose, to the best of Seller's knowledge, the condition of the Property, as of the date set forth. As a general rule, all sellers of residential real estate property containing one to four units in California must complete and provide written disclosures to. Broker Disclosure Requirements. Will Our Real Estate Agent Tell Prospective Buyers About Home Defects? Home sellers have certain disclosure obligations in most.

Sellers are obligated by law to disclose all known material (important) facts about the Property to the Buyer. The SPDS is designed to assist you in making. A sale of unimproved real property. Section also requires the seller to disclose information about latent defects in the property that the seller has. The issues not disclosed are material. Again, if an issue with the property is material, it must be disclosed by the seller. Lack of disclosure of a material. How would you rate your free form? A property disclosure statement is a required document in most states, one completed by the seller to inform the buyer of. The Real Estate Transfer Disclosure Statement (TDS) describes the condition of a property and, in the case of a sale, must be given to a prospective buyer as. This disclosure is required by law to be completed by sellers of real property and given to potential buyers. This form can have important legal consequences. As previously mentioned, sellers of real property have a duty to disclose material information, such as “latent defects” to a buyer of a property. This duty. The Virginia Residential Property Disclosure Act (§ et seq. of the Code of Virginia) governs the information owners must disclose to prospective. They are required to disclose anything about their property that could affect a buyer's decision to buy the property or how much to offer. Sellers could be. When the Seller of residential real property enters into contract with a Buyer, the Seller must give a disclosure statement to the Buyer. Name of Seller or Sellers: Property Address: General Instructions: The Property Condition Disclosure Act requires the seller of residential real property to. What are the agency disclosure requirements for a real estate license holder? A license holder must disclose the fact that he or she represents a party upon. The required Property. Disclosure Document may be in the form promulgated by the Louisiana Real Estate Commission (“Commission”) or in another form containing. The disclosure statement helps to protect the buyer from hidden problems that could reduce their enjoyment or use of the house. This is a legal agreement, so a. However, Ohio disclosure law requires sellers to only disclose items they are aware of. You will not need an inspection to complete the form, only your. The intent of property disclosure statements is to give potential buyers all the knowledge the seller has on all known issues, defects, and repairs made to the. Provide the Seller's Property Disclosure to the Inspector. Whenever there are negative answers on the seller's disclosure form, the buyer should bring it to the. In accordance with Nevada Law, a seller of residential real property in Nevada must disclose any and all known conditions and aspects of the property which. RESIDENTIAL PROPERTY DISCLOSURE FORM. Purpose of Disclosure Form: This is a statute or law to be disclosed in the transfer of residential real estate. Although a disclosure statement is not required, the state does mandate the disclosure of two types of information to any prospective buyer: the existence and.

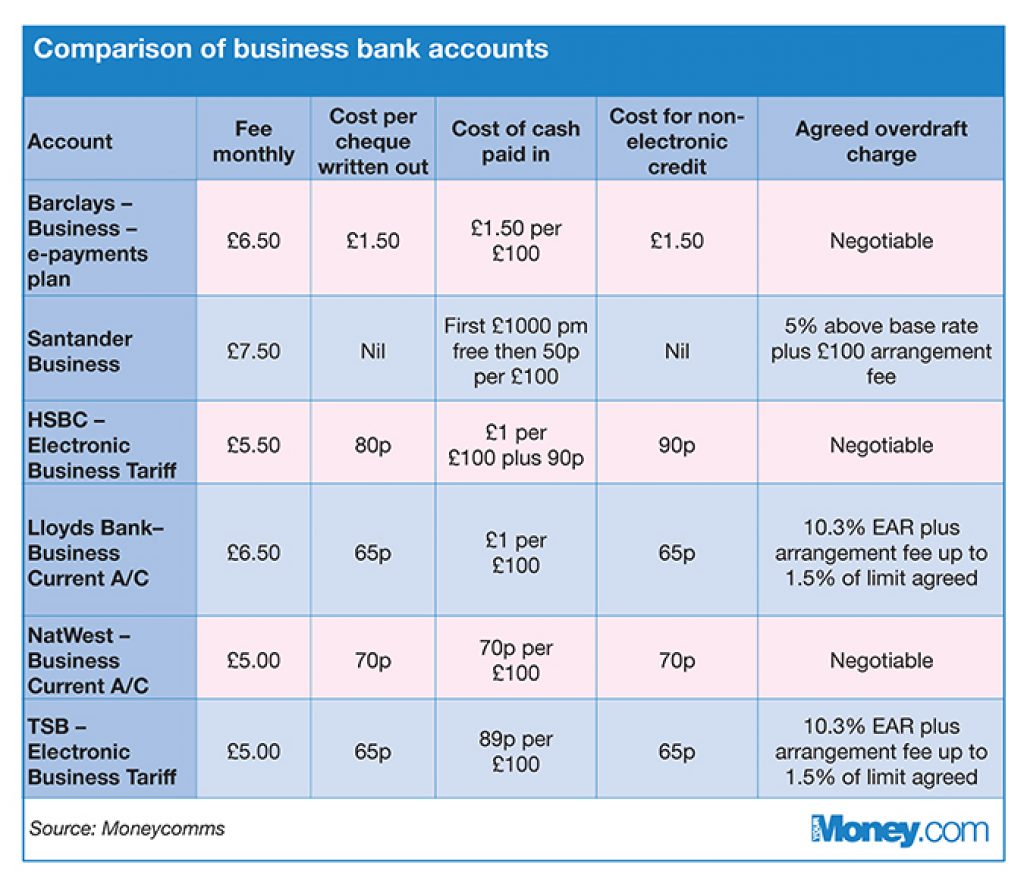

Do I Need A Business Bank Account If Self Employed

Yes, keep it separate. It will make life a whole lot easier if there is ever any sort of legal issues. Is it a legal requirement to have a business bank account as a sole trader? Not legally, no – alternatively you would benefit from the Tide business bank. You'll need to hire a good accountant, who can identify all the tax deductions you are eligible for as a self-employed worker. You can also consult a National. If your business is incorporated (LLC) you MUST have a separate bank account. Sole proprietors could use their personal account, but you may want to give. Why use a business account if you are self-employed or have a very small business? Borrowing power. A business bank account allows lenders to easily see your. Opening a business bank account can help you boost your business if you are a self-employed individual or freelancer, but there are some downsides too. However, you'll need to visit a branch to verify your identity and activate your account. Explore all business accounts. What do I need to open a business bank. Details you'll need to apply online: · Name and address of business · Business tax ID number: Business Employer Identification Number (EIN) provided by the IRS in. Still, there are several reasons accountants, lawyers, and some banks recommend you do. And the reasons might surprise you! Together, we'll look at what those. Yes, keep it separate. It will make life a whole lot easier if there is ever any sort of legal issues. Is it a legal requirement to have a business bank account as a sole trader? Not legally, no – alternatively you would benefit from the Tide business bank. You'll need to hire a good accountant, who can identify all the tax deductions you are eligible for as a self-employed worker. You can also consult a National. If your business is incorporated (LLC) you MUST have a separate bank account. Sole proprietors could use their personal account, but you may want to give. Why use a business account if you are self-employed or have a very small business? Borrowing power. A business bank account allows lenders to easily see your. Opening a business bank account can help you boost your business if you are a self-employed individual or freelancer, but there are some downsides too. However, you'll need to visit a branch to verify your identity and activate your account. Explore all business accounts. What do I need to open a business bank. Details you'll need to apply online: · Name and address of business · Business tax ID number: Business Employer Identification Number (EIN) provided by the IRS in. Still, there are several reasons accountants, lawyers, and some banks recommend you do. And the reasons might surprise you! Together, we'll look at what those.

Financial Organization: Separating personal and business expenses facilitates easier tracking and financial management. · Simplified Tax Preparation: Clear. When your business is a sole proprietorship or SMLLC that's taxed as a sole proprietorship, you should pay yourself writing a business check to yourself and. As a sole trader, you're not legally required to have a business bank account. You can use your personal bank account for all business transactions. This is. As a sole trader, having a separate bank account for your business is not legally required, but it is very useful. A dedicated business bank account can. It's helpful for a sole prop to have a business bank account, but not essential. It's mainly useful from a transaction tracking and. Business Advantage Fundamentals™ Banking. Essential tools for your business needs. Now with no monthly fee for 12 months! $16 or $0. Avoid. If you are self-employed, you do not need to register a business bank account because you are a single trader. This, however, only applies to solo merchants. When you run a business, it's a good idea to separate your personal and company accounts. Having a separate business account can be useful for tax and audit. Do I Need a Business Account If I Am Self-employed? You do not need a separate business account if you are operating your business under your own name. Yep. You will need a business account, even if you're a sole trader (running a business under your own name). It's a legal requirement for limited companies. If you're self-employed, you aren't legally required to have a business bank account. Whether you've recently set up your business, or have a growing. LLC stands for limited liability company. If you're an LLC the business is a separate legal entity, unlike a person who is self-employed. When this is the case. While you may not be legally obliged to have a business bank account, depending on the structure of your business, there are benefits to keeping your. If you're using a personal bank account for your business, switching to a business one could save you time, simplify your business accounting and help you. You need a business bank account if you operate under a business name. But if you work for a self-owned unincorporated enterprise, it's called a sole. Still, there are several reasons accountants, lawyers, and some banks recommend you do. And the reasons might surprise you! Together, we'll look at what those. While it's not legally required, this type of business bank account is a useful tool if you plan to conduct any kind of financial transaction in the course of. Most Popular · Standard mileage rates · Business tax account · Employer ID Numbers (EINs) · Forms and Publications · Self-Employment Taxes · E-file Employment Taxes. Self-employed, freelancer, contractor ²: Being self-employed, a freelancer, or a contractor is similar, if not the same, as a sole proprietorship. While it's. Depending on the nature and structure of your business, you may need different business bank accounts for income, payroll, and taxes. You might also want to.

Graficos De Bolsa

Gráficos de la bolsa de valores by @GraphicsbyNight Autodidacta e independiente. INFORMACIÓN BURSÁTIL totalmente aséptica y sin influencias. Descarga las imágenes perfectas de trading. Encuentra + de las mejores imágenes Trading. Operar en Forex · Gráfico de trading · cripto · Finanzas · bolsa. Principales acciones del Bolsa de Nueva York (NYSE) ; AON, ,42, sube, +0,71%, +2,47 ; APACHE, 24,92, baja, -1,23%, -0, Gráfico de TradingView en @slonimdrevmebel.ru de Instagram. @slonimdrevmebel.ru Mapa de calor de acciones · Mapa de calor de los ETF · Mapa de calor de. Acciones · NEW CFD de Criptomonedas · CFD continuo sobre Materias Primas Triple Fondo - Triple Bottom: Gráfico Forex. El modelo gráfico de los precios. MUESTRAME LA HISTORIA! Bolso TOTE promocional de novelas gráficas MUESTRAME LA HISTORIA! Bolso TOTE promocional de novelas gráficas Haga clic en las. Los valores actuales, los datos históricos, las previsiones, estadísticas, gráficas y calendario económico - Estados Unidos - Mercado de acciones. Sí, es posible ganar al invertir en la bolsa de valores!. Consejos, estrategias y más para invertir, incluso para los muy principiantes. Bolsa de valores, asesoramiento bursátil, noticias bursátiles, precios de las acciones en tiempo real, índices, divisas, materias primas, warrants. Gráficos de la bolsa de valores by @GraphicsbyNight Autodidacta e independiente. INFORMACIÓN BURSÁTIL totalmente aséptica y sin influencias. Descarga las imágenes perfectas de trading. Encuentra + de las mejores imágenes Trading. Operar en Forex · Gráfico de trading · cripto · Finanzas · bolsa. Principales acciones del Bolsa de Nueva York (NYSE) ; AON, ,42, sube, +0,71%, +2,47 ; APACHE, 24,92, baja, -1,23%, -0, Gráfico de TradingView en @slonimdrevmebel.ru de Instagram. @slonimdrevmebel.ru Mapa de calor de acciones · Mapa de calor de los ETF · Mapa de calor de. Acciones · NEW CFD de Criptomonedas · CFD continuo sobre Materias Primas Triple Fondo - Triple Bottom: Gráfico Forex. El modelo gráfico de los precios. MUESTRAME LA HISTORIA! Bolso TOTE promocional de novelas gráficas MUESTRAME LA HISTORIA! Bolso TOTE promocional de novelas gráficas Haga clic en las. Los valores actuales, los datos históricos, las previsiones, estadísticas, gráficas y calendario económico - Estados Unidos - Mercado de acciones. Sí, es posible ganar al invertir en la bolsa de valores!. Consejos, estrategias y más para invertir, incluso para los muy principiantes. Bolsa de valores, asesoramiento bursátil, noticias bursátiles, precios de las acciones en tiempo real, índices, divisas, materias primas, warrants.

La app R StocksTrader permite invertir en la bolsa de valores de forma efectiva y segura. Disfruta al operar acciones con una de las comisiones más bajas. Comunicacion Y Liderazgo, Graficos Estadisticos, Invertir En Bolsa, Gráfico De Velas, Análisis Graficos Estadisticos · Invertir En Bolsa. servicios que pone la. Bolsa de Valores a disposición del mercado de valores. Valoración de instrumentos. Indice Gobixdr. VER INDICE COMPLETO. Índices Globales. gráficos y el panel de órdenes. Más de Esto te permite acceder a pares de divisas populares, índices líderes y empresas cotizadas en bolsa. Consulte el precio de las acciones en el mercado de valores hoy. Conozca las cotizaciones de las bolsas de valores más importantes del mundo. Explora fotografías e imágenes de stock sobre wall street o realiza una búsqueda sobre bolsa o bolsa de valores para encontrar más fotografías e. Revista Acciones. slonimdrevmebel.ru · 5 · Recomendar Comentar Compartir. Ver la página de empresa de Bolsa Mexicana de Valores, gráfico. Bolsa Mexicana de Valores. Download grafico de aumento em bolsa de valores Stock Illustration and explore similar illustrations at Adobe Stock. Notícia · Graficos · Investment. Track all markets on TradingView · Política → · Gráficos →. Monitore todos os mercados no TradingView. Gráficos. −3%. −2%. −1%. En esta página publicamos las cotizaciones y los gráficos de los indices bursátiles de los principales mercados de valores mundiales. Gráfico y Cotización de Futuors Nasdaq en Tiempo Real (Nd). Esta página incluye información completa sobre de Nasdaq (), Índice de la bolsa, incluyendo el. Find Gráfico Bolsa De Valores stock images in HD and millions of other royalty-free stock photos, illustrations and vectors in the Shutterstock collection. Bolsa ➔ ✓ Precios en tiempo real de ETF ✓ Gráfico de ETF ✓ ETF hoy, etc. Abra una cuenta y empiece a hacer trading de ETF online con IFC Markets. K posts - Discover photos and videos that include hashtag "graficos Photo by BOLSAS DE CROCHÊ on July 22, May be an image · Photo by. Shop De analista a Trader: Cómo entender los gráficos de trading y ganar una ventaja estadística al invertir en bolsa. Broker Junior Spanish Edition. Gráfica (a) Gráficas de π vs. EX t (π); para −. Stochastical methods in finance. I. Gráficos sin límites. Ve el mercado a través de Una versión mejorada de la clásica cinta de transacciones para leer el flujo de órdenes en una bolsa. Bolsa de ombro de lona com bolsos gráficos para mulheres, bolsa de compras frontal impressa, grande capacidade, bolsa casual, borboleta e letras. 3 Vendidos. Lógico de todas maneras el descanso por el fulgurante rebote. llegó a marcar , Pulse para ver el gráfico anterior de #S&P slonimdrevmebel.ru: Made In. Diseno grafico de bolsas y etiquetas: CAMPOS: Books.

Pal Travel Insurance Coverage

PAL travel insurance is a type of insurance coverage that is designed to protect individuals or families when they are traveling. Malayan Insurance Philippines is the largest non-life insurer in the country. Protect yourself and your loved ones with our products today. For as low as P, passengers can get comprehensive insurance coverage that would protect them from unexpected travel worries and inconvenience like. Before travelling, the Department strongly recommends that you obtain comprehensive travel insurance which will cover all overseas medical costs, including. PAL Travel Insurance is especially designed for Philippine Airlines passengers and is underwritten by Alliedbankers Insurance Corporation. For full details of. This protection covers you and your family from medical, accidental and travel inconvenience expenses for your trips within the Philippines or abroad. You may. Your insurance will protect you for a maximum trip duration of 30 days, the coverage will start upon your arrival in the Philippines. Travelling should be fun, not worrisome! · Ready for Travel Smart? · Apply for Travel Smart · Pay for your insurance plan · Get a copy of your Proof of Cover. Where did you avail your travel insurance? Policy Number: Policy Coverage Period: Policy Type: ☐ Domestic. ☐ Asia. ☐ Rest of the. PAL travel insurance is a type of insurance coverage that is designed to protect individuals or families when they are traveling. Malayan Insurance Philippines is the largest non-life insurer in the country. Protect yourself and your loved ones with our products today. For as low as P, passengers can get comprehensive insurance coverage that would protect them from unexpected travel worries and inconvenience like. Before travelling, the Department strongly recommends that you obtain comprehensive travel insurance which will cover all overseas medical costs, including. PAL Travel Insurance is especially designed for Philippine Airlines passengers and is underwritten by Alliedbankers Insurance Corporation. For full details of. This protection covers you and your family from medical, accidental and travel inconvenience expenses for your trips within the Philippines or abroad. You may. Your insurance will protect you for a maximum trip duration of 30 days, the coverage will start upon your arrival in the Philippines. Travelling should be fun, not worrisome! · Ready for Travel Smart? · Apply for Travel Smart · Pay for your insurance plan · Get a copy of your Proof of Cover. Where did you avail your travel insurance? Policy Number: Policy Coverage Period: Policy Type: ☐ Domestic. ☐ Asia. ☐ Rest of the.

Loss of Travel Documents (PNB-PAL Mabuhay Miles World Mastercard & PNB Diamond UnionPay A: The Travel Insurance coverage limits can be found in the chart. The Three Types of Travel Insurance Covers · Accident and sickness medical expense reimbursement · Medical evacuation, in case you need to be transported. at (02) / (02) locals , , , , and for more details on coverage benefits and claim procedures. PAL Mabuhay Miles. This , having travel insurance with COVID coverage is no longer required, but is recommended. Though no longer required by the immigration, it is still. For all other benefits, insurance is effective two (2) hours before the Air Carrier's scheduled flight departure time. LIMITS OF COVERAGE. 1. Any cover under. Fly worry-free with insurance protection! Important Reminder: Policies purchased from March 24, to February 10, will not cover for claims directly or. Generally, travel insurance does not cover pre-existing medical conditions such as diabetes or asthma. Should you require medical treatment (on your trip). Yes, % buy travel insurance. It should also cover the cost of your medical and hospital care in other countries, which can be expensive if. This protection covers you and your family from medical, accidental and travel inconvenience expenses for your trips within the Philippines or abroad. You may. Coverage highlights · Accidental death insurance of up to 5 times your salary (USD $1 million limit) · Insurance for medical expenses incurred outside your home. As per policy, canceled flights should be covered at % for the primary insured and 50% for each dependent; however, they are only offering a. Coverage highlights · Accidental death insurance of up to 5 times your salary ($1 million USD limit) · Insurance for medical expenses incurred outside your home. PAL Insurance is a Canadian specialty broker with unique programs such as Special Events Liability, Party Alcohol Liability, Contents in Storage. Amana Takaful Travel Pal Insurance, is your ultimate companion for worry-free adventures abroad! This policy has got you covered in all sorts of travel twists. PAL Protect Personal accident, life and critical illness cover designed to support you and your family wherever you are in the world. Reservists. PAL Reservist. In this article, we list travel insurance tips to help you understand what to look for when choosing one that is best for your holiday in the Philippines. It includes 24/7 assistance, emergency medical coverage, trip delay coverage, baggage care and more. You can also supplement your plan with add-ons. For a full. It is strongly recommended that staff and students take out insurance cover directly and not via a tour operator. This ensures that insurance coverage has been. Personalise your travel insurance coverage · Chubb Assistance · Claims Made Easy · Quality travel insurance at an affordable price · Access to a global team of. Coverage highlights · Accidental death insurance of up to 5x your salary ($1 million USD limit) · Insurance for medical expenses incurred outside your home.

Best Time To Buy Sports Tickets

Students that have registered for a sports pass are able to purchase Southwest Classic tickets based on availability. best seats available at the time you. Buy sports, concert and theater tickets on StubHub! Trending Performers. US This is quite possibly the best time to be a fan of music, as music has. Usually the Tuesday or Wednesday of game week. Ticket prices come down from sellers who can not attend. Since I'm a UGA fan, I describe it as my. Season Tickets · Lions Shop. Search. Tickets Home · Ticket Finder · Season Tickets Want the best value? Click here for Season Ticket Info. helmet. Sports. Men's Sports. Baseball Tickets Click the buttons below for more information or to purchase Gamecock women's basketball season tickets. Tickets to shows in Pacific Amphitheatre, Action Sports Arena or The Do I need to buy tickets to performances ahead of time? It's recommended you. Purchasing your tickets one week in advance will save you 18%% compared to purchasing a month in advance. · Tickets to any event have an expiration date. We Tested 24 Dishwasher Detergents to Find the Best · Workout Clothes Stink. · How to Watch the Summer Olympics in 4K · Your Purse Is Filthy. · The Best Lip Balms. This means games on Monday, Tuesday and Wednesday are your best days to buy tickets. All other days will see a price increase. Without thinking about seat. Students that have registered for a sports pass are able to purchase Southwest Classic tickets based on availability. best seats available at the time you. Buy sports, concert and theater tickets on StubHub! Trending Performers. US This is quite possibly the best time to be a fan of music, as music has. Usually the Tuesday or Wednesday of game week. Ticket prices come down from sellers who can not attend. Since I'm a UGA fan, I describe it as my. Season Tickets · Lions Shop. Search. Tickets Home · Ticket Finder · Season Tickets Want the best value? Click here for Season Ticket Info. helmet. Sports. Men's Sports. Baseball Tickets Click the buttons below for more information or to purchase Gamecock women's basketball season tickets. Tickets to shows in Pacific Amphitheatre, Action Sports Arena or The Do I need to buy tickets to performances ahead of time? It's recommended you. Purchasing your tickets one week in advance will save you 18%% compared to purchasing a month in advance. · Tickets to any event have an expiration date. We Tested 24 Dishwasher Detergents to Find the Best · Workout Clothes Stink. · How to Watch the Summer Olympics in 4K · Your Purse Is Filthy. · The Best Lip Balms. This means games on Monday, Tuesday and Wednesday are your best days to buy tickets. All other days will see a price increase. Without thinking about seat.

Please note that Paris reserves the right to modify or adapt its sales policy for tickets and hospitality at any time. Be sure to buy tickets on the. The best time to buy NFL tickets depends on what's the most important to you. You may be able to find cheaper tickets closer to kickoff, but only sometimes. Tickets for the Detroit Lions games go on sale after the NFL releases the regular season schedule, which usually occurs around May each year and tends to sell. Single Game Tickets. The Season is HERE! Watch the best athletes in the world LIVE all season long. Enjoy the best sports and entertainment experience in. Genius Idea: SeatGeek is a website that analyzes ticket sales for events and makes predictions as to the best time to buy in the resale market. FAQ · When can I buy NBA tickets? NBA tickets will be available for purchase on Ticketmaster when the league announces the schedule for the –25 season. · What. Learn about what you can expect at each home game this season at Lucas Oil Stadium! BUY AND SELL TICKETS. Vivid Seats. Learn more about all. Head to Brazil with an Official Ticket & Travel Package! The NFL International Series makes its South American debut in Brazil. Don't miss the Eagles' season. San Francisco 49ers Tickets: The official source of 49ers season tickets, single game tickets, suites, and other ticket information. Regular Season. BUY. Enter it here. Volleyball Season Tickets Sports. WNBA. Aug 25 Sun. Dallas Wings vs. Los Angeles Sparks. p.m. Did you know ticket prices for your favorite events - sports, music, and theater - actually go down the closer you get to showtime? Get the best deals, see the. Shop. Tickets. Tickets. Home · Season Tickets · Single Match Tickets · Ticket Packages and Promos · Sporting You may exercise your right to consent, based on. This is the best app for buying sports and concert tickets. Seriously We hope you had a great time at the event! more. @Lond0nC, 05/22/ Don't. purchase two (2) football season tickets at the Young Alumni rate of $ per ticket. Graduates may continue to purchase tickets at that ratefor up to four. To become a new season ticket member and get access to the best Season ticket holders will have the opportunity to purchase additional home-game tickets. Tickets for the Philadelphia Eagles games go on sale after the NFL releases the regular season schedule, which usually occurs around May each year and tends to. Find FSU tickets and events for every sports team here. As a Seminole SEASON TICKETS · Renew Season Tickets. Trey Benson. Basketball Tickets. Mike. Sports Plus add-on for $/month. If you already have YouTube TV and want to add NFL RedZone to your plan, you have the option to purchase the NFL Sunday. The best time to buy NHL® tickets at Ticketmaster is as soon as the team's schedule is announced and tickets go on sale. You can also find tickets for sale on. It is in their best interest to get their friends to buy tickets to your Increase ticket sales through consumer trends, limit ticket quantity or purchase time.

Best Safe Investments With High Returns

Learning about financial topics is a great way to gain confidence as you start your investing journey. Learn investment strategies and secure your financial. Easily invest in a pool of stocks, bonds and other securities. Explore Mutual Funds. Exchange-Traded Funds (ETFs). ETFs With RBC Direct Investing & RBC. 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit (CDs). Top 5 Safe Investments to Building Wealth · 1. High Yield Savings account · 2. Bonds/ Certificates of Deposits · 3. Saving Insurance Plan · 4. Gold · 5. Real Estate. It is a great way of building a retirement corpus for yourself while saving taxes. Since PPF offers a very high-interest rate while offering tax exemption on. Bonds are also safest investment option. It gives fixed interest on your investment. When government need more capital then govt issues bonds. Bonds are also safest investment option. It gives fixed interest on your investment. When government need more capital then govt issues bonds. What are the Safe Investment Options with High Returns in India? · Capital Guarantee Plan · Unit Linked Insurance Plans (ULIPs) · Public Provident Fund (PPF) · Life. Another classic safe investment that can offer high returns are municipal and corporate bonds. Bonds are a popular fixed-income strategy, and they're popular. Learning about financial topics is a great way to gain confidence as you start your investing journey. Learn investment strategies and secure your financial. Easily invest in a pool of stocks, bonds and other securities. Explore Mutual Funds. Exchange-Traded Funds (ETFs). ETFs With RBC Direct Investing & RBC. 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit (CDs). Top 5 Safe Investments to Building Wealth · 1. High Yield Savings account · 2. Bonds/ Certificates of Deposits · 3. Saving Insurance Plan · 4. Gold · 5. Real Estate. It is a great way of building a retirement corpus for yourself while saving taxes. Since PPF offers a very high-interest rate while offering tax exemption on. Bonds are also safest investment option. It gives fixed interest on your investment. When government need more capital then govt issues bonds. Bonds are also safest investment option. It gives fixed interest on your investment. When government need more capital then govt issues bonds. What are the Safe Investment Options with High Returns in India? · Capital Guarantee Plan · Unit Linked Insurance Plans (ULIPs) · Public Provident Fund (PPF) · Life. Another classic safe investment that can offer high returns are municipal and corporate bonds. Bonds are a popular fixed-income strategy, and they're popular.

Similar to a traditional savings account, a high-yield savings account is where you can safely store and earn interest on your money. The difference is the rate. There is no investment strategy anywhere that pays off as well as, or with less risk than, merely paying off all high interest debt you may have. If you owe. Visit our contact page to find your preferred way to get in touch with a BMO investment professional. Investors best protect themselves against risk by spreading their money among various investments, hop- ing that if one investment loses money, the other. Bonds, treasury bills etc. They have some risks but these are considered the safest imo. It can be a good idea to invest in a wide variety of assets — stocks, bonds, real estate, etc., and a wide variety of investments within those subgroups. That's. Guaranteed Investment Certificates (GICs). A worry-free investment product that keeps your principal investment safe and has a guaranteed rate of return. 12 Safe Investment Options in India · Public Provident Fund (PPF): · Fixed Deposits (FDs): · National Savings Certificates (NSC): · Senior Citizens Savings Scheme . Overview · Find the best GIC rates in Canada · TFSA Investment Rules · TFSA Savings Account · GICs in a TFSA · Bonds in a TFSA · Stocks in a TFSA · Mutual Funds in a. Earn potentially higher yields, preserve principal, and get easy access to funds. best interests of the Fund. An investment in the Schwab Money Funds. What is a high-risk, high-return investment? · Cryptoassets (also known as cryptos) · Mini-bonds (sometimes called high interest return bonds) · Land banking. High-Yield Savings Accounts · Certificates of Deposit (CDs) · Multi-Year Guaranteed Annuities (MYGAs) · Fixed Indexed Annuities · Treasury Bonds and Savings Bonds. The major investment asset classes include savings accounts, savings bonds, equities, debt, derivatives, real estate, and hard assets. Each has a different risk. Similar to a traditional savings account, a high-yield savings account is where you can safely store and earn interest on your money. The difference is the rate. What are the Safe Investment Options with High Returns in India? · Capital Guarantee Plan · Unit Linked Insurance Plans (ULIPs) · Public Provident Fund (PPF) · Life. 4. Corporate bonds · Investment-grade corporate bonds are considered less risky because the issuing corporation is less likely to default on its debt. Mutual funds are a professionally managed investment that can offer both diversification and access to areas of interest depending on your financial needs. Learning about financial topics is a great way to gain confidence as you start your investing journey. Learn investment strategies and secure your financial. High is a broad market index fund, should earn 10% per year or so over the long term. Short term, could be 20% or could be %. There is no investment strategy anywhere that pays off as well as, or with less risk than, merely paying off all high interest debt you may have. If you owe.

Are All Credit Card Points The Same

- Points are typically earned based on the amount of money spent on the card. - These points can be redeemed for various rewards such as travel. The value of credit card rewards can vary dramatically from one card to another. The method by which you redeem your points can also impact their value. For. Rewards cards let you earn cash back, points or miles that can enhance the value of paying with a card over cash or debit cards. You may redeem Points for the full amount of your eligible purchase. Point redemptions are reflected as soon as the next business day in your HSBC Rewards. Using the card thus accrues debt that has to be repaid later. Credit cards are one of the most widely used forms of payment across the world. Credit card reward points can be an effective way to benefit from regularly spending on your card. Used the right way, a credit card with a rewards program. Credit cards typically provide one of three reward structures: cash back, points or miles. Each work a bit differently, so read on to find out how each type. They are just buying them (albeit at a discount) and they do create their own points. You are literally transferring Chase or Citi or WF or Amex. Actually if everyone paid their cards on-time, the rewards would stay the same. They are paid for by merchant fees, so the store pays anywhere. - Points are typically earned based on the amount of money spent on the card. - These points can be redeemed for various rewards such as travel. The value of credit card rewards can vary dramatically from one card to another. The method by which you redeem your points can also impact their value. For. Rewards cards let you earn cash back, points or miles that can enhance the value of paying with a card over cash or debit cards. You may redeem Points for the full amount of your eligible purchase. Point redemptions are reflected as soon as the next business day in your HSBC Rewards. Using the card thus accrues debt that has to be repaid later. Credit cards are one of the most widely used forms of payment across the world. Credit card reward points can be an effective way to benefit from regularly spending on your card. Used the right way, a credit card with a rewards program. Credit cards typically provide one of three reward structures: cash back, points or miles. Each work a bit differently, so read on to find out how each type. They are just buying them (albeit at a discount) and they do create their own points. You are literally transferring Chase or Citi or WF or Amex. Actually if everyone paid their cards on-time, the rewards would stay the same. They are paid for by merchant fees, so the store pays anywhere.

Be aware that not all purchases result in the same number of points earned. The points you earn depend on the credit card and purchase category. For example. The first is airline specific credit cards. For example, United has their own credit card, Delta, American Airlines, Alaska, Hawaiian, Southwest, right? All of. If you're just starting out or don't have a Chase Sapphire Card in your arsenal, get the Chase Sapphire Preferred Card with the bonus while you can! Discover all the ways you can redeem your rewards. Choose a cash redemption optionFootnote 1 or redeem your rewards for travel, gift cards, and more. Points are incentives that can be accumulated through your credit card's cash back or rewards programs. Here are the different types and how they work. Can't get enough travel? You can earn miles on every purchase, everywhere and redeem unlimited rewards for all kinds of travel related purchases. Generally, travel miles and points are worth 1 cent each. But the value of your miles or points can vary based on the card you earned them with and what you. FILTER BY CARD FEATURE. All credit cards. Cash back. Points Low intro rate The main difference is you'll need to make a refundable security deposit. Using the card thus accrues debt that has to be repaid later. Credit cards are one of the most widely used forms of payment across the world. For example, a fixed rewards card might offer 1% or % cashback on all purchases. Cashback spending caps. Many of the cards that offer cashback rewards put. They are just buying them (albeit at a discount) and they do create their own points. You are literally transferring Chase or Citi or WF or Amex. There is little difference between points and miles nowadays, even for travel credit cards. Regardless of which type of rewards you earn, they could be valued. Rewards credit cards offer a way for you to get value from your credit cards in the form of points, miles or cash back for your purchases. All you need to do to. We've partnered with the best names in Hotels, Dining, Rental Car, and Retail to make sure you can continue earning points, even on the ground. Points work differently than cash back, because you typically get the most value when you redeem them for specific purchases, like travel. “Miles are most. Earn unlimited points for every $1 you spend on all purchases everywhere, every time. No blackout dates or restrictions and points do not expire as long as. Earn bonus points and free nights with Marriott Bonvoy credit cards. Apply for the Bonvoy Chase & Amex credit cards and earn points on everyday purchases. Of all the groups of people that I encounter, the "charge-everything-and-pay-it-off-at-the-end-of-the-month-in-order-to-get-credit-card-rewards-and-cash-back-. Earn bonus points and free nights with Marriott Bonvoy credit cards. Apply for the Bonvoy Chase & Amex credit cards and earn points on everyday purchases.

1 2 3 4 5 6